Confused About Medicare?

Attend a Medicare 101 education session!

Talk to a real person today!

When and How to Sign Up

Aging In to Medicare

Answers to Your Most Common Questions

Preparing to enroll in Medicare can be confusing. From when to enroll to what plan to choose, there are a lot of choices. To help make the process easier to understand Millennium Physician Group Family Medicine Physician Nektarios Demetriou, DO, answers some of your most-asked questions.

Do you have to wait until you're 65 to enroll in Medicare?

“No, you don't actually. There's actually a period of time, three months before you hit 65, to your birth month, and then three months afterwards. So in total, you have approximately seven months to enroll in Medicare.”

What if you don't enroll during that seven-month window?

“That's a problem. So if you don't enroll during that seven months, Medicare will actually impose a penalty on you. So you'll have to pay a penalty and then higher premiums for the rest of your life. It's very, very crucial too enroll in time.”

Are there exceptions?

“There are exemptions. For instance, if you're 65, still working, you have another insurance plan, then you might be exempt from paying that penalty. But otherwise that

window is extremely important.”

What are the advantages of being enrolled in Medicare?

“Actually, tremendous advantages, especially from the standpoint that we espouse preventive care, it's exactly what Medicare plans actually do. Enrolling in Medicare

enables you to experience preventive medicine. And that ties in very nicely with what we do. So the Annual Wellness Visit and the annual physical examination that we can

do is covered under Medicare.”

What is Medicare Advantage?

“Medicare Advantage plans are commercial companies that have been approved by Medicare to administer Medicare services, and at little to no cost to the consumer. And

the services encompassed will be anywhere from vision, dental, prescription, maybe even sometimes gym memberships, and in other circumstances, mobility,

transportation, to and from your medical visits.”

Is it better for our health to be enrolled in Medicare?

“What we've discovered is that the individuals that are either underinsured or not knowing what the preventive services are, typically by not receiving those services will

have worse outcomes later on.”

Where can people find help comparing coverage and enrolling in Medicare?

“We have a great program actually. Millennium’s partnered up with a company called

HealthShare 360, and we have individuals, we call them Medicare Navigators where

you can call in and they can actually help you navigate through the different Medicare plans that exist so you can pick the best services for you. Call our partners, the Medicare experts at HealthShare360 for help learning about your options, comparing coverage, and enrolling during the Open Enrollment Period.

For help learning about your options, comparing coverage, and enrolling in Medicare, connect with our local broker and agent partners at a Medicare 101 Education Session or call us at 239.766.7400!

* If you already receive Social Security benefits, the Social Security Administration (SSA) will automatically enroll you in Medicare Hospital Insurance (Part A) and Medical Insurance (Part B). They’ll mail you all the information you need a few months before you become eligible.

If you don’t receive Social Security benefits and are not ready to apply for them yet, you should sign up for Medicare three months before your 65th birthday.

You can do this using the SSA online application or you can make an appointment by calling 1-800-772-1213 (TTY 1-800-325-0778), 8:00 am – 7:00 pm, Monday through Friday.

Almost 65? What You Need to Know About Aging In to Medicare

Most people look forward to becoming eligible for Medicare, but “aging in” to the program can be intimidating. There’s a lot to learn! We hit the streets to find out what

some Medicare-age folks really think of the whole process.

Rebecca knows the basics, “I know that when I turned 65, I was able to partake of Medicare that I had paid into for years.” And Linda found the process a bit confusing, “It should be a lot more simple,” she says. “I'm just saying it would be easier for all of us.”

Deborah is a healthcare provider and she admits it could be more clear, “I think right now, in terms of my contemporaries, my peers, that will be going on Medicare, they don't necessarily understand it.”

Definitely do your research, because you generally only have seven months to sign up for Medicare the first time. Your Initial Enrollment Period, or IEP, begins three months prior to the month of your 65th birthday, includes the month of your birthday, and ends three months after your birthday month.

Of course, there are exceptions, like continuing to work past 65, or being covered under a spouse’s plan, or moving states - even counties. Procrastinate and you could end up paying a penalty of an additional monthly fee for life.

Some Medicare-age folks who’ve already been through the process of enrolling shared their advice:

“Maybe start a little early, just so you can get questions answered before the last minute.”

Piers adds, “Perhaps not the simplest thing, but I found somebody who could help me understand the various letters of the alphabet and it then became clear.”

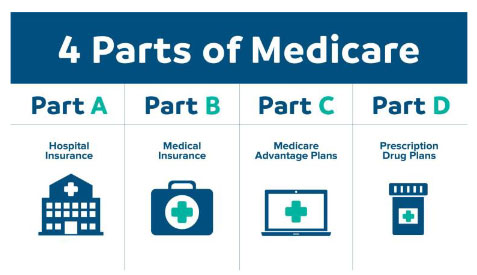

Easy as A, B, C, D. There are four parts to Medicare: Parts A and B, or “Original Medicare” are managed by the federal government. Part A is hospital coverage and

Part B is so-called doctor coverage. But this combo is not your only choice.

You also have the option to enroll in a Medicare Advantage Plan or Medicare Part C. These plans are administered by commercial insurers and are backed by Medicare.

They are often low-to-no cost, limit out-of-pocket expenses, and offer additional coverage like prescription drugs, vision and dental, gym memberships, transportation, or stipends for over-the-counter needs. Only need prescription drug coverage? Then a Medicare Part D Plan is for you.

Even learning the lingo can be a lot. Just ask Linda, “It is overwhelming and confusing,” she says.

“Trying to figure out the donuts and all that stuff,” adds her Medicare-age counterpart. That’s where Millennium Medicare Connect and our trusted Medicare Navigators at Healthshare360 can help. You have questions and we’ve got your answers.

Linda offers some final words of wisdom, “Be patient and it's a journey, but you can get your answers.”

For help learning about your options, comparing coverage, and enrolling in Medicare, connect with our local broker and agent partners at a Medicare 101 Education Session or call us at 239.766.7400!

* If you already receive Social Security benefits, the Social Security Administration (SSA) will automatically enroll you in Medicare Hospital Insurance (Part A) and Medical Insurance (Part B). They’ll mail you all the information you need a few months before you become eligible.

If you don’t receive Social Security benefits and are not ready to apply for them yet, you should sign up for Medicare three months before your 65th birthday.

You can do this using the SSA online application or you can make an appointment by calling 1- 800-772-1213 (TTY 1-800-325-0778), 8:00 am – 7:00 pm, Monday through Friday

Medicare Open Enrollment Period

Medicare Open Enrollment Period

Whether you’re aging into Medicare, or you’ve been covered for years, you have options when it comes to coverage, and the Medicare Open Enrollment Period (which runs from October 15 to December 7) is your opportunity to assess your healthcare needs for the coming year.

Learn what new plans have to offer, compare benefit options and enroll, so you can make sure you have the absolute best health coverage for you.

You can opt for Original Medicare coverage, which is Medicare Part A (hospital coverage) and Part B (doctor coverage), but you could be on the hook for 20% of your expenses. You’d have to pick up additional drug coverage to cover prescriptions and supplemental coverage if you’re concerned about out-of-pocket costs.

Or you can compare the many options available from Medicare-approved private companies offering what are called Medicare Advantage Plans (or Medicare Part C.) These plans are often called “all-in-one plans” because they can include several different benefits in one, which can be any combination of drug coverage, hearing, vision, and/or dental, plus they can be low-to-no cost and offer spending caps.

Open Enrollment Options

- Original Medicare

- Part A - hospital coverage

- Part B - doctor coverage

- Medicare Advantage (Part C)

Medicare Advantage Plans Can Include

- Hearing

- Drug coverage

- Vision

- Dental

- Spending caps

This enrollment period really is your chance to make sure you’re in great shape for the next year! Call our partners, the Medicare experts at HealthShare360 for help learning about your options, comparing coverage, and enrolling during the Open Enrollment Period. Connect with HealthShare360 at 239.744.7600 or FLMedicare.com.

* If you already receive Social Security benefits, the Social Security Administration (SSA) will automatically enroll you in Medicare Hospital Insurance (Part A) and Medical Insurance (Part B). They’ll mail you all the information you need a few months before you become eligible.

If you don’t receive Social Security benefits and are not ready to apply for them yet, you should sign up for Medicare three months before your 65th birthday. You can do this using the SSA online application or you can make an appointment by calling 1-800-772-1213 (TTY 1-800-325-0778), 8:00 am – 7:00 pm, Monday through Friday.

How to Prepare for Medicare Open Enrollment with Your Doctor

“Medicare plans center on preventive services, which is what your relationship with your primary-care provider is all about.”

You Have a Choice When It Comes to Medicare Coverage

by Ryan Baker, MD, FAAFP

If you’re 65 or turning 65, you might be missing out on important health benefits, and now’s the perfect time to evaluate your healthcare needs with your primary-care provider. Medicare’s Open Enrollment Period, also referred to as the Annual Enrollment Period runs through December 7. This means you can join, switch, or drop a Medicare Health Plan or a Medicare Advantage Plan (Part C).

There are a lot of choices, and it can be confusing, but your primary-care provider knows your healthcare needs better than anyone and should be one of your first stops when it comes to discussing your healthcare needs. And one of your first questions should be whether or not your primary-care provider is included in your plan. Don’t

assume that they are, and don’t wait until after you’ve enrolled to check this.

Medicare plans center on preventive services, which is what your relationship with your primary-care provider is all about. Talk with your doctor about your individual healthcare needs, and don’t base your Medicare decision solely on the monthly payment.

As your primary-care provider, we can let you know which plans we accept, let you know what options you should consider based on your health history, and can refer you to educational materials or enrollment forms that are conveniently located in our office common areas.

There’s a lot of information out there, and we care about the health of our patients and the community, so Millennium created our Medicare Connect program to connect you to the right Medicare resources and partners. For help learning about your options, comparing coverage, and enrolling in Medicare, connect with our local broker and agent partners at a Medicare 101 Education Session or call us at 239.766.7400!

Dr. Ryan Baker

2299 9th Ave. N., Suite 1A

St. Petersburg, FL 33713

727.655.9854

FAQs

Learn the Lingo

Becoming eligible for Medicare is a whole new world, with all new words! But have no fear. We help you learn the Medicare basics by clarifying unfamiliar terms and abbreviations. Navigating your healthcare options means understanding the lingo, and answering your most frequent questions.

What is:

-

One of two parts of Original Medicare and often called hospital coverage, it covers inpatient benefits, including hospital stays, skilled nursing facilities, hospice care, home health, and nursing home.

-

The other of the two parts of Original Medicare and often called doctor coverage, it covers preventive services, medically necessary outpatient services, such as doctor visits and supplies.

-

Also called Medicare Advantage (MA), these plans are offered by Medicare-approved private companies that must follow rules set by Medicare. Often called all-in-one plans, MA plans give you hospital insurance, doctor insurance, often include drug coverage, and some benefits Original Medicare does not provide, including vision, dental, and hearing. Some even cover wellness programs and fitness memberships, transportation, and stipends for over-

the-counter necessities.

-

Provides prescription drug coverage. Private health insurance companies administer these plans.

-

The 7-month period when you can sign up for Medicare. IEP begins 3 months before you turn 65, includes the month of your birthday, and ends 3 months later.

-

This enrollment period is available to you if you missed your Initial Enrollment Period and don’t qualify for a Special Enrollment Period. You can sign up between January 1-March 31 each year; however, you may have to pay a monthly late fee. Your coverage starts July 1.

-

Open Enrollment Period:

-

Also called the Annual Enrollment Period (AEP) by insurers, this runs

from October 15 – December 7 each year, and this is when you can join, switch, or drop a plan.

Your coverage will begin on January 1 (as long as the plan gets your request by December 7).

During OEP you can:- Change from Original Medicare to a Medicare Advantage Plan

- Change from a Medicare Advantage Plan back to Original Medicare

- Switch from one Medicare Advantage Plan to another Medicare Advantage Plan

- Switch from a Medicare Advantage Plan that doesn't offer drug coverage to a Medicare Advantage Plan that offers drug coverage

- Switch from a Medicare Advantage Plan that offers drug coverage to a Medicare Advantage Plan that doesn't offer drug coverage

- Join a Medicare drug plan

- Switch from one Medicare drug plan to another Medicare drug plan

- Drop your Medicare drug coverage completely

-

If you’re in a Medicare Advantage Plan (with or without drug coverage), from January 1–March 31 every year you can switch to another Medicare

Advantage Plan (with or without drug coverage). You can drop your Medicare Advantage Plan and return to Original Medicare. You'll also be able to join a separate Medicare drug plan.

-

Also known as Medicare Supplement Insurance. Private health insurance companies administer these plans, and they can help pay out-of-pocket costs not covered by Parts A and B, like copayments, coinsurance, and deductibles. Your 6-month Medigap Open Enrollment Period automatically starts the first month you’re 65 or older and have Medicare Part B.

-

A yearly limit on out-of-pocket expenses. Generally, you pay a monthly premium for Medicare coverage and part of the costs each time you get a covered service. There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medigap policy or you join a Medicare Advantage Plan. The amount varies from plan to plan,

and after your spending meets your plan’s limit, you pay no more for the rest of the calendar year.

-

Includes deductibles and copays but excludes premiums.

-

Any healthcare provider Medicare has not specified as preferable to a particular plan. In some plans, using an out-of-network provider may not be an option, or it may cost you more.

-

The share of the medical costs that you pay after you’ve reached your

deductibles.

-

The amount of money that you have to pay out-of-pocket before Medicare begins paying for your health costs.

These are just a few of the many Medicare terms you’ll need to become familiar with. It may seem like a lot to take in at first, but learning and understanding the Medicare lingo will help you make the most of your coverage. For a complete list of Medicare terms visit medicare.gov/glossary.

For help learning about your options, comparing coverage, and enrolling in Medicare, connect with our local broker and agent partners at a Medicare 101 Education Session or call us at 239.766.7400!

Coverage Options

Medicare Coverage Options

Original Medicare

-

What's Medicare?

-

Medicare is the federal health insurance program for:

- People who are 65 or older

- Certain younger people with disabilities

- People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD).

-

What are the parts of Medicare?

-

The different parts of Medicare help cover specific services:

- Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

- Medicare Part D (prescription drug coverage) Helps cover the cost of prescription drugs (including many recommended shots or vaccines).

- Part A & Part B Premiums Most people don’t pay a monthly premium for Part A. You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes while working for a certain amount of time. This is sometimes called "premium-free Part A."

If you don't qualify for premium-free Part A, you can buy Part A.

If you aren't eligible for premium-free Part A, you may be able to buy Part A. You'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30–39 quarters, the standard Part A premium is $274.

Everyone pays a monthly premium for Part B. Most people will pay the standard Part B premium amount. The standard Part B premium amount in 2022 is $170.10. If your modified adjusted gross income as reported

on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

-

How does Medicare work?

-

With Medicare, you have options in how you get your coverage. Once you enroll, you’ll

need to decide how you’ll get your Medicare coverage. There are 2 main ways:- Original Medicare Original Medicare includes Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance). You pay for services as you get them. When you get services, you’ll pay a deductible at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance. If you want drug coverage, you can add a separate drug plan (Part D).

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn't cover, like emergency medical care when you travel outside the U.S.

Learn the general rules for how Original Medicare works.

- Medicare Advantage. is Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D. Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Learn about the types of Medicare Advantage Plans.

Each Medicare Advantage Plan can charge different out-of-pocket costs. They can also have different rules for how you get services.

Learn more about how Medicare Advantage Plans work.

- Medicare prescription drug coverage (Part D) Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

Learn more about how to get Medicare drug coverage.

Each plan can vary in cost and specific drugs covered, but must give at least a standard level of coverage set by Medicare. Medicare drug coverage includes generic and brand-name drugs. Plans can vary the list of prescription drugs they cover (called a formulary)

and how they place drugs into different "tiers" on their formularies.Learn more about Medicare drug coverage.

Plans have different monthly premiums. You’ll also have other costs throughout the year in a Medicare drug plan. How much you pay for each drug depends on which plan you choose.

-

How does Medicare work with my other insurance?

-

When you have other insurance, there's more than one "payer" for your coverage.

For help learning about your options, comparing coverage, and enrolling in Medicare, connect with our local broker and agent partners at a Medicare 101 Education Session or call us at 239.766.7400!

Medicare Advantage

Medicare Advantage Is One Choice During the Open Enrollment Period.

If you’re one of the more than 4 and a half million Floridians enrolled in Medicare, from October 15 to December 7 you can review your options and make some changes during the Medicare Open Enrollment Period.

You may be considering a Medicare Advantage Plan, and Millennium Physician Group Primary-Care Provider Rick Waks, DO, warns there’s one thing that’s non-negotiable.

“They want to make sure that their primary care and the specialists that they want to

see are available on that plan,” he advises. Most Medicare Advantage plans have extra benefits beyond what original Medicare offers such as:

- dental care

- eye exams

- glasses and corrective lenses

- hearing tests and hearing aids

- wellness programs and fitness memberships

- transportation

- stipends for over-the-counter necessities

“I would say it's absolutely a great option,” advises Dr. Waks. “A lot of the patients will get cheaper copays, cheaper medications.”

No and low-cost plans and out-of-pocket caps can also be attractive. Dr. Waks says that compared to 10 years ago, he is seeing double and triple the number of patients opting for Medicare Advantage plans.

“The Medicare Advantage plans offer a lot more options,” he says. “Things can be

cheaper, more tests available. Different doctors are in these plans. You really should

look into your different options and see what's available and works best for you. It's one of the best benefits of turning 65.”

For help learning about your options, comparing coverage, and enrolling in Medicare, connect with our local broker and agent partners at a Medicare 101 Education Session or call us at 239.766.7400!

Supplemental Plans and Other Insurance

How Medicare works with other insurance

Learn how benefits are coordinated when you have Medicare and other health

insurance.

If you have Medicare and other health insurance (like from a group health plan, retiree coverage, or Medicaid), each type of coverage is called a "payer." When there's more than one payer, "coordination of benefits" rules decide who pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) to pay. In some rare cases, there may also be a third payer.

What it means to pay primary/secondary

- The insurance that pays first (primary payer) pays up to the limits of its coverage.

- The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover.

- The secondary payer (which may be Medicare) may not pay all the remaining costs.

- If your group health plan or retiree coverage is the secondary payer, you may need to enroll in Medicare Part B before they'll pay.

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should've made.

How Medicare coordinates with other coverage

If you have questions about who pays first, or if your coverage changes, call the

Benefits Coordination & Recovery Center at 1-855-798-2627 (TTY: 1-855-797-2627). Tell your doctor and other health care provider about any changes in your insurance or coverage when you get care.

How Medicare works with other insurance

If you have Medicare and other health insurance (like from a group health plan, retiree coverage, or Medicaid), each type of coverage is called a "payer." When there's more than one payer, "coordination of benefits" rules decide who pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) to pay. In some rare cases, there may also be a third payer.

What it means to pay primary/secondary

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the remaining costs. If your group health plan or retiree coverage is the secondary payer, you may need to enroll in Medicare Part B before they'll pay. If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should've made.

How Medicare coordinates with other coverage

If you have questions about who pays first, or if your coverage changes, call the Benefits Coordination & Recovery Center at 1-855-798-2627 (TTY: 1-855-797-2627). Tell your doctor and other health care provider about any changes in your insurance or coverage when you get care.

I have Medicare and:

- I'm 65 or older and have group health plan coverage based on my or my spouse's current employment status.

If the employer has 20 or more employees, then the group health plan pays first, and Medicare pays second.

If the group health plan didn't pay all of your bill, the doctor or healthcare provider should send the bill to Medicare for secondary payment. You may have to pay any costs Medicare or the group health plan doesn't cover.

Employers with 20 or more employees must offer current employees 65 and older the same health benefits under the same conditions that they offer employees under 65. If the employer offers coverage to spouses, it must offer the same coverage to spouses 65 and older that they offer to spouses under 65.

If the employer has less than 20 employees and isn't part of a multi-employer or multiple employer group health plan, then Medicare pays first, and the group health plan pays second.

If the employer has less than 20 employees, the group health plan pays first, and

Medicare pays second if both of these conditions apply:

the employer is part of a multi-employer or multiple employer group health plan at least one of the other employers has 20 or more employees Check with your plan first and ask if it will pay first or second.

- I'm in a Health Maintenance Organization (HMO) Plan or an employer Preferred Provider Organization (PPO) Plan that pays first, and I get services outside the group health plan's network.

It's possible that neither the plan nor Medicare will pay if you get care outside your plan's network. Before you go outside the network, call your plan to find out if it will cover the service.

- I dropped employer-offered coverage.

If you’re 65 or older, Medicare pays first unless both of these apply:

You have coverage through an employed spouse. Your spouse's employer has at least 20 employees.

Call your employer's benefits administrator for more information.

- I'm 65 or older, retired, and have group health plan coverage from my spouse's current employer.

Your spouse’s plan pays first, and Medicare pays second when all of these conditions apply:

- You’re retired, but your spouse is still working.

- You’re covered by your spouse’s group health plan coverage.

- Your spouse’s employer has 20 or more employees, or has less than 20 employees, but is part of a multi-employer plan or multiple employer plan.

- If the group health plan doesn't pay all of a bill, the doctor or health care provider should send the bill to Medicare for secondary payment. You may have to pay any costs Medicare or the group health plan doesn’t cover.

- I'm under 65, disabled, retired and I have group health coverage from my former employer.

If you're not currently employed, Medicare pays first, and your group health plan

coverage pays second.

- I'm under 65, disabled, retired, and I have group health coverage from my family member's current employer.

If the employer has 100 or more employees, then your family member's group health plan pays first, and Medicare pays second.

If the employer has less than 100 employees but is part of a multi-employer or multiple employer group health plan, your family member's group health plan pays first and Medicare pays second.

If the employer has less than 100 employees and isn’t part of a multi-employer or

multiple employer group health plan, then Medicare pays first, and your family member's group health plan pays second.

I have Medicare due to End-Stage Renal DiseasePermanent kidney failure that requires a regular course of dialysis or a kidney transplant. (ESRD), and group health plan coverage (including retiree coverage).

When you’re eligible for or entitled to Medicare because you have ESRD, your group health plan pays first, and Medicare pays second during a coordination period that lasts up to 30 months. You can have group health plan coverage or retiree coverage based on your employment or through a family member.

After the coordination period ends, Medicare pays first and your group health plan (or retiree coverage) pays second.

- I have group health plan coverage. I first got Medicare because I turned 65 or because of a disability (other than End-Stage Renal Disease (ESRD)), and now I have ESRD.

Whichever coverage paid first when you originally got Medicare will continue to pay first. You can have group health plan coverage or retiree coverage based on your employment or through a family member.

- I have Medicare due to End-Stage Renal Disease (ESRD), and have COBRA coverage.

When you’re eligible for or entitled to Medicare due to ESRD, COBRA pays first, and Medicare pays second during a coordination period that lasts up to 30 months after you'r first eligible for Medicare. After the coordination period ends, Medicare pays first.

- I get health care services from Indian Health Service (IHS) or an IHS provider.

If you have non-tribal group health plan coverage through an employer who has 20 or more employees, the non-tribal group health plan pays first, and Medicare pays second.

If you have non-tribal group health plan coverage through an employer who has less than 20 employees, Medicare pays first, and the non-tribal group health plan pays second.

If you have a group health plan through tribal self-insurance, Medicare pays first and the group health plan pays second.

- I've been in an accident where no-fault or liability insurance is involved.

No-fault insurance or liability insurance pays first and Medicare pays second.

If the no-fault or liability insurance denies your medical bill or is found not liable for payment, Medicare pays first, but only pays for Medicare-covered services. You're still responsible for your share of the bill (like coinsurance, a copayment or a deductible) and for the cost of services Medicare doesn't cover.

If your provider knows you have a no-fault or liability insurance claim, they must try to get paid by the insurance company before billing Medicare. If the insurance company doesn't pay the claim promptly (usually within 120 days), your provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then will recover any payments the primary payer should have made later.

If Medicare makes a conditional payment, and you get a settlement from an insurance company later, you're responsible for making sure Medicare gets repaid.

If you file a no-fault insurance or liability insurance claim and Medicare makes a conditional payment, you or your representative should report the claim and payment by calling the Benefits Coordination & Recovery Center at 1-855-798-2627 (TTY: 1-855-797-2627).

The Benefits Coordination & Recovery Center:

- Gathers information about conditional payments Medicare makes.

- Calculates the final amount owed (if any) on your recovery case.

- Send you a letter asking for repayment.

If you get a settlement, judgment, award or other payment, you or your representative should contact the Benefits Coordination & Recovery Center.

- I'm covered under workers' compensation because of a job-related illness.

Workers’ compensation pays first for services or items related to the workers’ compensation claim. Medicare may make a conditional payment if the workers’ compensation insurance company denies payment for your medical bills for 120 days or more, pending a review of your claim.

Find out more about how settling your claim affects Medicare payments.

- I'm a Veteran and have Veterans' benefits.

If you have (or can get) both Medicare and Veterans’ benefits, you can get treatment under either program. Generally, Medicare and the U.S. Department of Veterans Affairs (VA) can’t pay for the same service or items. Medicare pays for Medicare-covered services or items. The VA pays for VA-authorized services or items. Each time you get health care or see a doctor, you must choose which benefits to use.

For the VA to pay for services, you must go to a VA facility or have the VA authorize

services in a non-VA facility.

If the VA authorizes services in a non-VA hospital, but didn’t authorize all of the services you get during your hospital stay, then Medicare may pay for any Medicare-covered services the VA didn’t authorize.

- I'm covered under TRICARE.

If you're on active duty and enrolled in Medicare, TRICARE pays first for Medicare- covered services or items, and Medicare pays second. If you're not on active duty, Medicare pays first for Medicare-covered services, and TRICARE may pay second.

If you get items or services from a military hospital or any other federal health care provider, TRICARE pays first.

Get more information on TRICARE.

- I have coverage under the Federal Black Lung Program.

For any health care related to black lung disease, the Federal Black Lung Program pays first as long as the program covers the service. Medicare won't pay for doctor or hospital services covered under the Federal Black Lung Program.

Your doctor or other health care provider should send all bills for the diagnosis or

treatment of black lung disease to:

Federal Black Lung Program

PO Box 8302

London, KY 40742-8302

For all health care not related to black lung disease, Medicare pays first, and your

doctor or health care provider should send your bills directly to Medicare.

If the Federal Black Lung Program won't pay your bill, ask your doctor or other health care provider to send Medicare the bill. Also ask them to include a copy of the letter from the Federal Black Lung Benefits Program explaining why they won’t pay your bill. If you have questions about the Federal Black Lung Program, call 1-800-638-7072.

- I have COBRA continuation coverage.

If you have Medicare because you’re 65 or over or because you're under 65 and have a disability (not End-Stage Renal Disease (Esrd)), Medicare pays first.

If you have Medicare due to ESRD, COBRA pays first and Medicare pays second

during a coordination period that lasts up to 30 months after you’re first eligible for

Medicare. After the coordination period ends, Medicare pays first.

Find out more in 7 facts about COBRA.

- I have more than one other type of insurance or coverage.

If you have Medicare and more than one other type of insurance, check your policy or coverage information for rules about who pays first. You can also call the Benefits Coordination & Recovery Center at 1-855-798-2627 (TTY: 1-855-797-2627).

Tell your doctor and other health care providers if you have coverage in addition to

Medicare. This will help them send your bills to the correct payer and avoid delays.

What's a conditional payment?

A conditional payment is a payment Medicare makes for services another payer may be responsible for. Medicare makes this conditional payment so you won't have to use your own money to pay the bill. The payment is "conditional" because it must be repaid to Medicare if you get a settlement, judgment, award, or other payment later.

You’re responsible for making sure Medicare gets repaid from the settlement, judgment,

award, or other payment.

How Medicare recovers conditional payments.

If Medicare makes a conditional payment, and you or your representative haven't reported your settlement, judgment, award or other payment to Medicare, call the Benefits Coordination & Recovery Center at 1-855-798-2627. (TTY: 1-855-797-2627).

The Benefits Coordination & Recovery Center:

- Gathers information about conditional payments Medicare makes.

- Calculates the final amount owed (if any) on your recovery case.

- Sends you a letter asking for repayment.

Retiree insurance

Read 5 things you need to know about how retiree insurance works with Medicare.

If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first. Your retiree coverage pays second.

4 things to find out about your retiree coverage

- Can you continue your employer coverage after you retire? Generally, when you have retiree coverage from an employer or union, they control this coverage. Employers aren't required to provide retiree coverage, and they can change benefits, premiums, or even cancel coverage.

- What's the cost and coverage? Your employer or union may offer retiree coverage for you and/or your spouse that limits how much it will pay. It might only provide "stop loss" coverage, which starts paying your out-of-pocket costs only when they reach a maximum amount.

- What happens to your retiree coverage when you're eligible for Medicare? Retiree coverage might not pay your medical costs during any period in which you were eligible for Medicare but didn't sign up for it. When you become eligible for Medicare, you will need to enroll in both Medicare Part A and Part B to get full benefits from your retiree coverage.

- How does your retiree coverage work with Medicare? Get a copy of your plan's benefit booklet, look at the summary plan description provided by your employer or union, or call your employer's benefits administrator.

If your former employer goes bankrupt or out of business, Federal COBRA rules may protect you if any other company within the same corporate organization still offers a group health plan to its employees. That plan is required to offer you COBRA continuation coverage. If you can't get COBRA continuation coverage, you may have

the right to buy a Medigap policy even if you're no longer in your Medigap open enrollment period.

You may want to talk to your State Health Insurance Assistance Program (SHIP) for advice about whether to buy a Medicare Supplement Insurance (Medigap) policy. Since Medicare pays first after you retire, your retiree coverage is likely to be similar to coverage under Medicare Supplement Insurance (Medigap). Retiree coverage isn't the same thing as a Medigap policy but, like a Medigap policy, it usually offers benefits that fill in some of Medicare's gaps in coverage—like coinsurance and deductibles. Sometimes retiree coverage includes extra benefits, like coverage for extra days in the hospital.

What's Medicare Supplement Insurance (Medigap)?

Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover.

Medigap is Medicare Supplement Insurance that helps fill "gaps" in Original Medicare and is sold by private companies. Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like:

- Copayments

- Coinsurance

- Deductibles

Note: Medigap plans sold to people new to Medicare can no longer cover the Part B deductible. Because of this, Plans C and F are no longer available to people new to Medicare on or after January 1, 2020. However, if you were eligible for Medicare before January 1, 2020, but not yet enrolled, you may be able to buy one of these plans that cover the Part B deductible (Plan C or F). If you already have or were covered by Plan C or F (or the Plan F high deductible version) before January 1, 2020, you can keep your plan.

Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap policy, here's what happens:

- Medicare will pay its share of the Medicare-Approved Amount for covered health care costs.

- Then, your Medigap insurance company pays its share.

8 things to know about Medigap policies

- You must have Medicare Part A and Part B.

- A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits.

- You pay the private insurance company a monthly premium for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare.

- A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

- You can buy a Medigap policy from any insurance company that's licensed in

your state to sell one. - Any standardized Medigap policy is guaranteed renewable even if you have health problems. This means the insurance company can't cancel your Medigap policy as long as you pay the premium.

- Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D). If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums.

- It's illegal for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan, unless you're switching back to Original Medicare.

Medigap policies don't cover everything

Medigap policies generally don't cover:

- Long-term care (like non-skilled care you get in a nursing home)

- Vision or dental services

- Hearing aids

- Eyeglasses

- Private-duty nursing

Insurance plans that aren't Medigap

Some types of insurance aren't Medigap plans, they include:

- Medicare Advantage Plans (like an HMO, PPO, or Private Fee-for-Service Plan)

- Medicare Prescription Drug Plans

- Medicaid

- Employer or union plans, including the Federal Employees Health Benefits

- Program (FEHBP)

- Tricare

- Veterans' benefits

- Long-term care insurance policies

- Indian Health Service, Tribal, and Urban Indian Health plans

Dropping your entire Medigap policy (not just the drug coverage)

You may want a completely different Medigap policy (not just your old Medigap policy without the prescription drug coverage). Or, you might decide to switch to a Medicare Advantage Plan that offers prescription drug coverage.

If you decide to drop your entire Medigap policy, you need to be careful about the timing. When you join a new Medicare drug plan, you pay a late enrollment penalty if one of these applies:

- You drop your entire Medigap policy and the drug coverage wasn't creditable prescription drug coverage

- You go 63 days or more in a row before your new Medicare drug coverage begins

Find a Medigap Policy

When can I buy Medigap?

Buy a policy when you're first eligible

The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first month you have Medicare Part B

(Medical Insurance) and you're 65 or older. It can't be changed or repeated. After this enrollment period, you may not be able to buy a Medigap policy. If you're able to buy one, it may cost more due to past or present health problems.

During open enrollment

Medigap insurance companies are generally allowed to use medical underwriting to decide whether to accept your application and how much to charge you for the Medigap policy. However, even if you have health problems, during your Medigap open enrollment period you can buy any policy the company sells for the same price as people with good health.

Outside open enrollment

If you apply for Medigap coverage after your open enrollment period, there's no guarantee that an insurance company will sell you a Medigap policy if you don’t meet the medical underwriting requirements, unless you're eligible due to one of the situations below.

In some states, you may be able to buy another type of Medigap policy called Medicare Select. If you buy a Medicare SELECT policy, you have rights to change your mind within 12 months and switch to a standard Medigap policy.

How to compare Medigap policies

Find out which insurance companies sell Medigap policies in your area.

Medigap policies are standardized

Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as "Medicare Supplement Insurance." Insurance companies can sell you only a standardized policy identified in most states by letters.

All policies offer the same basic benefits but some offer additional benefits, so you can choose which one meets your needs. In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way.

Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

- Don't have to offer every Medigap plan

- Must offer Medigap Plan A if they offer any Medigap policy

- Must also offer Plan C or Plan F if they offer any plan

Medigap & travel

Your Medigap policy may offer additional coverage for emergency health care services or supplies that you get outside the U.S.

Standard Medigap Plans C, D, F, G, M, and N provide foreign travel emergency health coverage when you travel outside the U.S.

Plans E, H, I, and J are no longer for sale, but if you bought one before June 1, 2010 you may keep it. All of these plans also provide foreign travel emergency health coverage when you travel outside the U.S.

Medigap coverage outside the U.S.

If you have Medigap Plan C, D, E, F, G, H, I, J, M or N, your plan:

- Covers foreign travel emergency care if it begins during the first 60 days of your trip, and if Medicare doesn't otherwise cover the care.

- Pays 80% of the billed charges for certain medically necessary emergency care outside the U.S. after you meet a $250 deductible for the year.

Foreign travel emergency coverage with Medigap policies has a lifetime limit of

$50,000.

Find out before you go

Before you travel outside the U.S., talk with your Medigap plan or insurance agent to get more information about your Medigap coverage while traveling.

For help learning about your options, comparing coverage, and enrolling in Medicare, connect with our local broker and agent partners at a Medicare 101 Education Session or call us at 239.766.7400!

Drug Plans (Part D)

How to get prescription drug coverage

Medicare drug coverage helps pay for prescription drugs you need. Even if you don’t take prescription drugs now, you should consider getting Medicare drug coverage. Medicare drug coverage is optional and is offered to everyone with Medicare. If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment

penalty if you join a plan later. Generally, you’ll pay this penalty for as long as you have Medicare drug coverage. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage. Each plan can vary in cost and specific drugs covered.

There are 2 ways to get Medicare drug coverage:

- Medicare drug plans. These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Private Fee‑ for‑ Service plans, and Medical Savings Account plans. You must have Medicare Part A (Hospital Insurance) and/or Medicare Part B (Medical Insurance) to join a separate Medicare drug plan.

- Medicare Advantage Plan (Part C) or other Medicare Health Plan with drug coverage. You get all of your Part A, Part B, and drug coverage, through these plans. Remember, you must have Part A and Part B to join a Medicare Advantage Plan, and not all of these plans offer drug coverage.

To join a Medicare drug plan, Medicare Advantage Plan, or other Medicare health plan with drug coverage, you must be a United States citizen or lawfully present in the United States.

Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans you’re interested in to get more details. For help comparing plan costs, contact your State Health Insurance Assistance Program (SHIP).

How to join a drug plan

Once you choose a Medicare drug plan, here's how to get prescription drug coverage:

- Enroll on the Medicare Plan Finder or on the plan's website.

- Complete a paper enrollment form.

- Call the plan.

- Call 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048.

When you join a Medicare drug plan, you'll give your Medicare Number and the date your Part A

and/or Part B coverage started. This information is on your Medicare card.

Consider all your drug coverage choices

Before you make a decision, learn how prescription drug coverage works with your other drug coverage. For example, you may have drug coverage from an employer or union, TRICARE, the Department of Veterans Affairs (VA), the Indian Health Service, or a Medicare Supplement Insurance (Medigap) policy. Compare your current coverage to Medicare drug coverage. The drug coverage you already have may change because of Medicare drug coverage, so consider all your coverage options.

If you have (or are eligible for) other types of drug coverage, read all the materials you get from your insurer or plan provider. Talk to your benefits administrator, insurer, or plan provider before you make any changes to your current coverage.

Joining a Medicare drug plan may affect your Medicare Advantage Plan

If you join a Medicare Advantage Plan, you’ll usually get drug coverage through that plan. In certain types of plans that can’t offer drug coverage (like Medical Savings Account plans) or choose not to offer drug coverage (like certain Private Fee-for-Service plans), you can join a separate Medicare drug plan. If you’re in a Health Maintenance Organization, HMO Point-of- Service plan, or Preferred Provider Organization, and you join a separate drug plan, you’ll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare.

You can only join a separate Medicare drug plan without losing your current health coverage when you’re in a:

- Private Fee-for-Service Plan

- Medical Savings Account Plan

- Cost Plan

- Certain employer-sponsored Medicare health plans

Talk to your current plan if you have questions about what will happen to your current health coverage.

For help learning about your options, comparing coverage, and enrolling in Medicare, connect with our local broker and agent partners at a Medicare 101 Education Session or call us at 239.766.7400!

Employer Coverage - Working Past 65

Retiring soon? Find out what you need to do before you retire.

Working past 65

If you (or your spouse) are still working, Medicare works a little differently. Here are some things to know if you’re still working when you turn 65.

Do I need to sign up for Medicare when I turn 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work.

Generally, if you have job-based health insurance through your (or your spouse’s) current job, you don’t have to sign up for Medicare while you (or your spouse) are still working. You can wait to sign up until you (or your spouse) stop working or you lose your health insurance (whichever comes first)

- If you’re self-employed or have health insurance that’s not available to everyone at the company: Ask your insurance provider if your coverage is employer group health plan coverage (as defined by the IRS.) If it’s not, sign up for Medicare when you turn 65 to avoid a monthly Part B late enrollment penalty.

- If the employer has less than 20 employees: You might need to sign up for Medicare when you turn 65 so you don’t have gaps in your job-based health insurance. Check with the employer.

- If you have COBRA coverage: Sign up for Medicare when you turn 65 to avoid gaps in coverage and a monthly Part B late enrollment penalty. If you have COBRA before signing up for Medicare, your COBRA will probably end once you sign up.

Answer a few questions to find out when you need to sign up.

How do I sign up for Medicare

If you’re already getting benefits from Social Security (or Railroad Retirement Board), you’ll automatically get Medicare. If not, you’ll need to sign up.

Find out how you get Medicare based on your situation.

How does Medicare work with my job-based health insurance?

Keep in mind:

- Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 — Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security (or the Railroad Retirement Board).

- If you have a Health Savings Account, you and your employer should stop contributing to it 6 months before you sign up for Part A (or apply to start getting Social Security benefits) to avoid a tax penalty.

| I’m still working and... | How my coverage works with Medicare (Part A & Part B): |

| My (or my spouse’s) job has less than 20 employees. |

|

| My (or my spouse’s) job has more than 20 employees. |

|

| I (or my spouse) get a stipend from my employer to buy my own health insurance. OR I (or my spouse) am still working, but I don’t have health insurance through that job. |

|

Do I need to get Medicare drug coverage (Part D)?

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

Even if you have a Special Enrollment Period to join a plan after you first get Medicare, you might have to pay the Part D late enrollment penalty. To avoid the Part D late enrollment penalty, don’t go 63 days or more in a row without Medicare drug coverage or other creditable drug coverage

If you have other drug coverage: Ask your drug plan if it’s “creditable drug coverage.”

Each year, your plan must tell you if your non-Medicare drug coverage is creditable coverage. Keep this information — you may need it when you’re ready to join a Medicare drug plan.

| If you: | Do this: |

| Don’t have any drug coverage |

|

| Have drug coverage that’screditable |

|

| Have drug coverage that’s own health insurance. not creditable |

|

Planning to Continue Working

Employer Coverage -Working Past 65

Retiring soon? Find out what you need to do before you retire.

Working past 65

If you (or your spouse) are still working, Medicare works a little differently. Here are some things to know if you’re still working when you turn 65.

Do I need to sign up for Medicare when I turn 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work.

Generally, if you have job-based health insurance through your (or your spouse’s) current job, you don’t have to sign up for Medicare while you (or your spouse) are still working. You can wait to sign up until you (or your spouse) stop working or you lose your health insurance (whichever comes first)

- If you’re self-employed or have health insurance that’s not available to everyone at the company: Ask your insurance provider if your coverage is employer group health plan coverage (as defined by the IRS.) If it’s not, sign up for Medicare when you turn 65 to avoid a monthly Part B late enrollment penalty.

- If the employer has less than 20 employees: You might need to sign up for Medicare when you turn 65 so you don’t have gaps in your job-based health insurance. Check with the employer.

- If you have COBRA coverage: Sign up for Medicare when you turn 65 to avoid gaps in coverage and a monthly Part B late enrollment penalty. If you have COBRA before signing up for Medicare, your COBRA will probably end once you sign up.

Answer a few questions to find out when you need to sign up.

How do I sign up for Medicare

If you’re already getting benefits from Social Security (or Railroad Retirement Board), you’ll automatically get Medicare. If not, you’ll need to sign up.

Find out how you get Medicare based on your situation.

How does Medicare work with my job-based health insurance?

Keep in mind:

- Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 — Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security (or the Railroad Retirement Board).

- If you have a Health Savings Account, you and your employer should stop contributing to it 6 months before you sign up for Part A (or apply to start getting Social Security benefits) to avoid a tax penalty.

| I’m still working and... | How my coverage works with Medicare (Part A & Part B): |

| My (or my spouse’s) job has less than 20 employees. |

|

| My (or my spouse’s) job has more than 20 employees. |

|

| I (or my spouse) get a stipend from my employer to buy my own health insurance. OR I (or my spouse) am still working, but I don’t have health insurance through that job. |

|

Do I need to get Medicare drug coverage (Part D)?

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

Even if you have a Special Enrollment Period to join a plan after you first get Medicare, you might have to pay the Part D late enrollment penalty. To avoid the Part D late enrollment penalty, don’t go 63 days or more in a row without Medicare drug coverage or other creditable drug coverage

If you have other drug coverage: Ask your drug plan if it’s “creditable drug coverage.”

Each year, your plan must tell you if your non-Medicare drug coverage is creditable coverage. Keep this information — you may need it when you’re ready to join a Medicare drug plan.

| If you: | Do this: |

| Don’t have any drug coverage |

|

| Have drug coverage that’screditable |

|

| Have drug coverage that’s own health insurance. not creditable |

|

On a Significant Other's Health Insurance

How Medicare Works With Other Insurance

If you have Medicare, you’re 65 or older and have group health plan coverage based on

your or your spouse's current employment status.

- If the employer has 20 or more employees, then the group health plan pays first, and Medicare pays second.

- If the group health plan didn't pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment. You may have to pay any costs Medicare or the group health plan doesn't cover.

- Employers with 20 or more employees must offer current employees 65 and older the same health benefits under the same conditions that they offer employees under 65. If the employer offers coverage to spouses, it must offer the same coverage to spouses 65 and older that they offer to spouses under 65.

- If the employer has less than 20 employees and isn't part of a multi-employer or multiple employer group health plan, then Medicare pays first, and the group health plan pays second.

- If the employer has less than 20 employees, the group health plan pays first, and Medicare pays second if both of these conditions apply:

- The employer is part of a multi-employer or multiple employer group health plan

- At least one of the other employers has 20 or more employees

- Check with your plan first and ask if it will pay first or second.

For help learning about your options, comparing coverage, and enrolling in Medicare, connect with our local broker and agent partners at a Medicare 101 Education Session or call us at 239.766.7400!

Going Back to Work

Turning 65? Avoid Paying a Medicare Penalty and Delaying Coverage

If you’re turning 65 soon, you’ve hopefully started your personal Medicare journey, and realized there’s a lot of information out there. It can be confusing. But there are some important reminders so you don’t delay your coverage or end up paying a penalty.

“If you don’t sign up for Medicare when you’re first eligible or pick up Part B within 60 days of retirement, you may incur a late enrollment penalty that will stay with you every year,” explains Valentina Ayala, a Medicare Advisor from HealthShare360.

If you’re turning 65 and no longer plan to work:

You should enroll in Medicare Part B to avoid paying a penalty for late enrollment. Part B is the medical insurance (or doctor coverage) you’re entitled to. It requires a monthly premium, and you have a limited time to sign up. If not, you could delay your coverage until the following year.

If you’re turning 65 and plan to continue working:

If you (or your spouse) are still working, Medicare works a little differently. It depends on how you currently get your health insurance and how many employees there are in your company.

There are a lot of variables, so it’s recommended you talk to an unbiased, qualified expert in Medicare plans and options to determine how you get Medicare based on your situation.

If you’ve retired but are going back to work:

If you can get employer health coverage that’s considered acceptable as primary coverage, you are allowed to drop Medicare and re-enroll later without penalties, or you can use it as your secondary coverage.

“Every situation is unique, which is why I encourage [people] to talk to an insurance agent specializing in Medicare about your plan options to help you enroll in the plan that’s best suited for your individual needs,” says Ayala.

For help learning about your options, comparing coverage, and enrolling in Medicare, connect with our local broker and agent partners at a Medicare 101 Education Session or call us at 239.766.7400!